Does grazing management make a difference? Can we raise livestock and wildlife and take carbon out of the atmosphere and put it in soil on the same piece of land? Meet Peter Byck, self-described scientist wrangler and producer of Roots So Deep, a four-part documentary series that explores the world of adaptive cattle farmers and their conventional farming neighbors. Adaptive multi-paddock grazing is one of the faces of regenerative agriculture. Listen to this interview to learn about researched results from caring for land well. The Roots So Deep documentary film series shows, rather than tells, how we can have our cake and eat it too -- how grazing patterns can increase soil carbon, increase wildlife diversity, reduce water runoff and soil erosion, and improve financial health of family farms.

The Art of Range Podcast is supported by the Idaho Rangeland Resources Commission; Vence, a subsidiary of Merck Animal Health; and the Western Extension Risk Management Education Center.

Transcript

[ Music ]

>> Welcome to The Art of Range, a podcast focused on rangelands and the people who manage them. I'm your host, Tip Hudson, range and livestock specialist with Washington State University Extension. The goal of this podcast is education and conservation through conversation. Find us online at artofrange.com.

[ Music ]

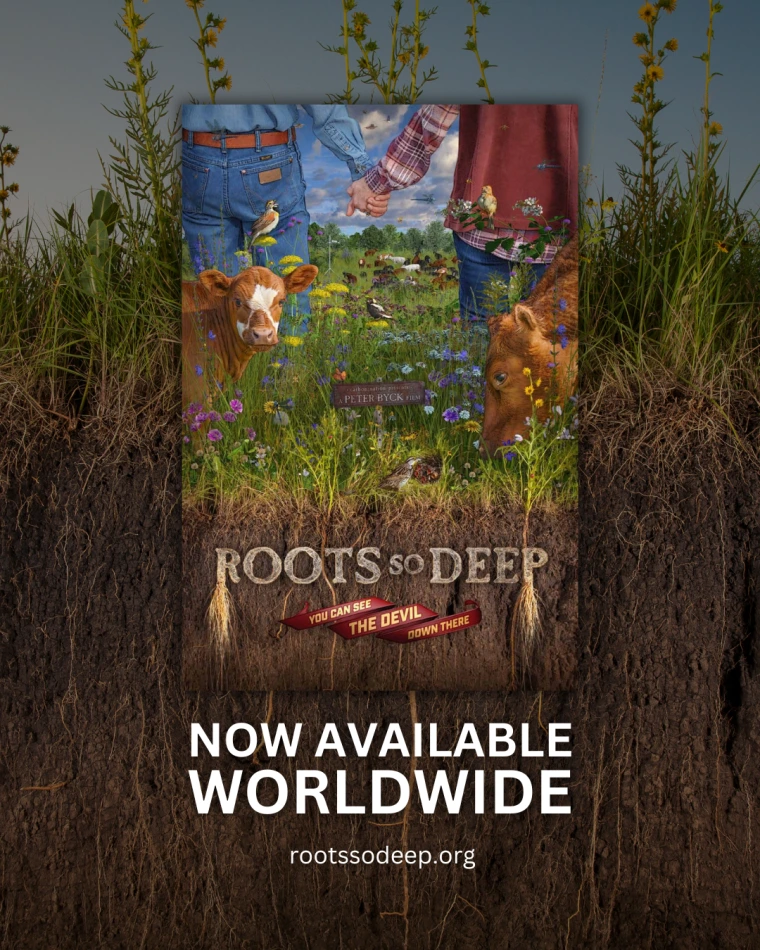

Welcome back to The Art of Range. My guest today is Peter Byck, the filmmaker and self-described scientist wrangler behind the documentary series Roots So Deep and, before that, Carbon Nation. Roots So Deep just went global a few weeks ago, and that's after the series already had millions of viewings. And I recently watched the whole thing with pleasure, and it is my pleasure to be talking to him today. Peter, welcome.

>> Thank you, Tip. It's a real pleasure to be here. We were just talking about scientists. Can I make an adjustment?

>> Please do.

>> Our series hasn't been seen by millions yet, but our clips on social media has been seen by over 114 million, views.

>> Got it.

>> So just wanted to -- just to correct that for the record.

>> No, that's great. That's good to know. I did watch the whole thing, and it was the movies and not the clips.

>> Yeah, yeah.

>> Well, this interests me because I've been a range nerd since I was in high school and got into wildlife biology in college before I quickly switched over to rangeland ecology. Because what I liked about rangeland ecology, which was a term I'd never even heard of, having grown up in Arkansas, was the integrated nature of that discipline. But it was holistic in the sense that, I guess by definition, rangeland science was everything in or on the landscape and how it all relates to each other. From people to plants to birds to microbes. And since then I've been around ranchers of all stripes and ranch sizes, you know, irrigated, non-irrigated, Western, rangelands, South. So the topics that you cover in this documentary are of great interest to me, and that makes it difficult to know where to start. But maybe we'll start with you. How did you get involved in making films, and is filmmaker still the proper term for what you're doing?

>> Yeah, it's definitely the proper term. Whether I'm a good filmmaker or not is up to anyone who's watching my stuff, but I definitely am a filmmaker. It hit me in college that I wanted to make films, and I went to film school in Los Angeles, a place called CalArts, California Institute of the Arts, and then lived in L.A. for 26 years. Film career of lots of editing, some directing, and I made a documentary called Garbage that won South by Southwest. And then a number of years later, I made a documentary called -- when I say I made, it's always a team. It's always a team. But I am the director of these films. I made a film called Carbon Nation, which was about solutions to climate change. And that brought me to grazing, and that brought me to soils, and that brought me to treat the soils well. It can be an amazing solution for climate change, and if you treat them poorly, it can be a cause. And I then honed in from the soils and the grazing from a conversation I had with Allen Williams in 2012 and realized I really want to focus on regenerative grazing, what we are calling adaptive multi-paddock grazing. And so in 2013, I was hired by Arizona State University to teach documentary filmmaking here. And so I wanted to focus on this grazing, and I filmed Allen Williams, Gabe Brown, and Neil Dennis in the summer of 2013. And that became our short film Soil Carbon Cowboys, which began my journey into this realm of grazing as an amazing solution for an enormous amount of problems. Water security, food security, rural economies, farmer well-being, animal well-being, nutrient density in the food, wildlife habitat restoration. And the more I learned about the grazing, the adaptive grazing, the more I realized how powerful a tool it was. But there was no science other than a couple papers from Richard Teague out of Texas A&M. And so with Richard and Allen and a number of other people, we formed a science team in 2014 to ask these questions and compare adaptive grazing with conventional grazing across the fence and see what the differences were in a whole suite of metrics. Like you're saying, it's a system, right? You think of rangeland or you think of farmland, cattle farmland, it's a system. And so that's how I'm here. And that's how the docuseries was made, because we filmed everything that we did in the field. We filmed all the farmers, you know, both sides of the fence. We filmed the scientists out in the field, and then we waited years for the data to come back. And then we presented it to the farmers many times together with their neighbor. And I think we might have helped build relationships between neighbors just because we were curious. And they said yes to our requests of can we film you all together. And we found out that the conventional neighbors were curious about what the adaptive regenerative neighbor was doing. They just didn't want to bug them. They didn't want to ask about it. They didn't want to get in their business. And we found that the adaptive regenerative practicing neighbor was very excited to talk about it but just didn't want to start sounding like a know-it-all and tell people what to do. That was the last thing they wanted to do with their neighbors.

>> Or they have the perception that everybody is biased against it from the start.

>> They had the perceptions. I had those perceptions. We made a bunch of short films, Soil Carbon Cowboys being the first, and we made 10 total. And that's called the Carbon Cowboys series. And it's on YouTube. You can see all the shorts. I thought the neighbor was judgmental because I never interviewed the neighbor. I only interviewed the farmers doing the regenerative practice during that whole series of films while we were developing and fundraising for this research that's in Roots So Deep. But in Roots So Deep, I got the privilege, and I underlined that. You could probably hear I capitalized it. The privilege of meeting all the farmers and meeting the folks across the fence and learning from them. And that just changed everything. All my preconceptions were out the window, out the window.

>> Yeah, you mentioned in the film that working with or doing research on entire ecosystems is difficult. And we've never been able to get at it with what I call lab bench science. Because the whole idea behind at least the version of research and scientific method that we get taught in elementary school is that the way you do it is by achieving ceteris paribus, holding everything constant except for the one thing you want to manipulate and then measuring the results. But it's crazy difficult to do that unless you're working at, you know, microplots and petri dishes.

>> Yeah. Yeah, and of course I come at this not as a scientist or a trained scientist or a farmer or, you know, even someone who was raised near farmland. I was born and raised in Louisville, Kentucky. And, you know, you can drive 15 minutes out of Louisville and you're on farmland, but that's as close as I ever got, really. And so I came at this myself through film training. And in any film, you need a lot of different skill sets. So the idea of just asking one scientist to be on this team, it never even occurred to me. It never occurred to me. So it naturally came together that I met all these different types of scientists. And when I emailed everybody and said, hey, do you want to be part of this grant that I heard about that couples human and natural systems? They all emailed back very quickly because they were excited about working on something that was very much a systems piece where they got to meet different people. And Richard Teague, who you know, he talks about when he met Jon Lundgren at our first meeting. And Jon was talking about the ecology of bugs that Teague realized, wow, I've got a lot more to learn here. And that's what's been so amazing about the science team is the cross-pollinization of knowledge and the eagerness to learn what the other ones are working on. And then it affects the science. So, you know, we always knew we wanted to do something out in the real world. We always knew it was going to be a lot of different metrics that we were studying. We can get into the details of that whenever you want. So we always knew. Well, not we, the scientists always assumed it was going to get messy. I learned that doing real science on real ranch sizes and, you know, farm scale science is messy, but I learned it by doing, by being there with the team. You know, I didn't know that ahead of time. But the idea of studying nature in its own element, right? And farming is utilizing nature. And that's really the key thing I've learned so much from this whole journey from people both on our science team and people outside our science team who we've become very good friends with is, you know, you can farm fighting nature and wake up and say to yourself, what am I going to kill today? These are quotes from people, farmers. Or am I going to farm with nature? How am I going to keep things living today? And just that dynamic of approach is fascinating to me that there are farmers who are taught to kill everything but the thing they're growing. And it's a lot of work. It's a lot of money. It's not being a very good neighbor downstream, even though I know every farmer I've ever met wants to be a good neighbor.

>> Yeah, and those things are -- I think they're culturally deep. There's some long history to that. You know, most of agriculture in this country, at least, you know, what seems to be sort of European style row crop agriculture, influenced pasture management thinking over the last 200 years. But in that model, you know, we're trying to modify nature to simplify the plant community, oftentimes to a monoculture, and then, you know, modify the whole agroecosystem to be whatever the farmer wants it to be and use -- spend money on seed, fertilizer, herbicides, tillage, insecticides, you know, you name it. We homogenize and then we maximize, and that's what farming is supposed to look like. And it feels like there's a bit of a backlash against that, partly I think forced by nature in some places sort of falling apart, like farmers that have been using synthetic fertilizer for 100 years and then soil pH crashes and then you don't have any soil organic matter. And the price of petroleum goes up, and now it doesn't look like it's quite such a good idea to do essentially hydroponic farming. And I'm aware that I'm speaking about conventional farming in somewhat of a pejorative sense, but, you know, at least in the world of grazing management, it feels like that's not the most profitable way to do it, even if profit was the only motivating factor. But I think it's not for most people, which you also uncovered.

>> Yeah. And back to your point about, you know, how we're talking about different methods of producing food, we've had for a very long time a very strong ethos of no blame, no shame. And there's no blame of a method of grazing that someone's learned from their parents and their grandparents. It's just what we said to the conventional farmers in our study when we met them was, we think we found a way that's going to be more enjoyable and more profitable. Would you help us in doing the research on your land, and we'll do it exact same methods on your neighbor's land, and we'll find out together. And then some of them said, well, what happens if you find out there's a better way to do it? We said, thank you for asking that question, because that's good news, just that question. We'll help. You know, we've got Allen Williams on our team, and that's what we offered everybody is like, if you want to meet Allen at any time, before or after the data, you just let us know. And not to give away too much from episode four, but that was pretty good response of folks who wanted to meet Allen and learn about their land with him on their land, digging up their soil, looking at it. So we've never thought that anyone was doing anything wrong. And you saw in the film, they were asking us that. They were assuming we thought that.

>> Right.

>> And I just had to clarify our purpose, which was to be of service, to be helpful, if the help was of interest, right, you know? And we can't do it without data. We knew that. And so getting the science done well and rigorously was expensive, time consuming. We felt it had to be that way. And a lot of the scientists on our team have since gone on to do their own big giant research projects that grew out of this one, which is really exciting, because that means more science is getting done. But I can say now from my experience on this that, yes, our research was in the Southeast U.S. We're replicating a lot of that research in North and South Dakota right now, and I don't have any results yet from that. But I've seen this method of grazing where you get all your animals in one herd, you get them to a small spot, you keep them there for a short period of time, and then move them on and let most of the farm or ranch rest most of the time. Where you don't eat the forage all the way down, eat half, leave half, 40%, 60%, depends on what time of year and all that stuff. Those universal methods I've seen work everywhere I've landed on this planet. And I've been on tour with Roots So Deep, the docuseries, for 18 months now. I just got back from Australia. I've been to South Africa, all over bits of Europe and all over the U.K., Canada, the U.S. And if those methods are used, those universals, it's very successful for the farmer. And to me, that's really good news because I'm not politically aligned with a lot of the farmers that I work with, but I'm soil health aligned with every farmer I work with. Every farmer I know loves their farm. I come in there going, this place is gorgeous. And every farmer I know wants to leave that piece of land better than when they found it. It's just a lot of farmers are not taught about soil health yet. And again, that's not a blame thing. That's just a data point. And so for us, as we're out on this tour with this film and we're building our social media campaign, which is getting really, really, really good traction, we're building community, people share knowledge. We're finding out that when a farmer learns the building blocks of soil health, like what Allen Williams has taught me and what he teaches the farmers in episode four, it's pretty logical. You want your soil to absorb water and not fall apart when it's wet. You want that rain to stay on your land and not wash off. You want your soil covered. That's like the game, man. Just cover your soil with growing living plants, as many different varieties as possible, different depths of roots. You're now letting the microbial community do its thing. And when the microbes are happy and thriving and diverse and abundant, man, you've got yourself an engine for success.

>> And to your point, land health is politically agnostic. There was Richard Knight, who's from Colorado, wrote about what he called the Radical Middle, you know, capital R, capital M. But these are things that people agree about. When you get people on a physical landscape and everything is working well, there's really not much disagreement about that, regardless of what their, you know, political affiliations are or in the rangeland community, you know, what their management philosophy commitments might be. And part of what I like about this series is that it does an excellent job of combining science, communication, and persuasion. Because we had a -- I've probably said this several times on the podcast, but we did a conference on water quality 20 years ago. Water quality related to livestock production. And we had a human behavior guy out of Rutgers who said that influencing people is more complicated or complex than just relaying facts. You know, we tend to think that if I give you the same facts that I've got, that you'll make the same decision that I would with the same sets of facts. But people are more complex than that. And there was a -- oh, I think a Scottish politician who was supposedly quoting a musician from ancient Greece who said, let me write the songs of the nation, and I don't care who writes its laws. With the idea that we're influenced by more than just, you know, a supposedly rational, front of the brain apprehension of ideas. And I think this does an excellent job of persuading. And in fact, I was going to ask you where the title Roots So Deep (You Can See the Devil Down There) came from. But I'm inclined to leave that bait on the hook and tell people to listen to the series to find out.

>> Yep. It gets answered by the time you're done with the series. We don't leave that as a mystery.

>> Yes. No, I love the title. And it gets to this idea of persuasion. It's really intriguing to me that you have so many people that are not part of agriculture that are paying attention to this. And I mentioned in the -- just a few minutes of talking before we started recording that even though I'm sort of in this social universe, I had not heard of this until it was forwarded to me from a friend of mine who has a relative who's a military pilot. And he heard about it somewhere and was so taken by it, was so impressed, you know, with this big idea, capital B, capital I, that he wanted me to hear about it. Yeah, that's really exciting.

>> Well, it's funny. You know, everybody eats, right? So there really is no -- everyone is connected to this, as I'm sure you've thought and talk about things like that. But the military connection, you know, a country that feeds itself well and that cycles its water well is a secure country. And a country that kills its soils and doesn't feed itself and has to buy food from other places is not a secure country. So it's directly connected to the military. And so we actually -- we've been working with the Farmer Veterans Coalition and meeting other folks who are helping veterans who've come home with PTSD and traumatic brain injuries and want to kill themselves. That when they get out onto a farm, especially a regenerative farm, it's healing. And to me, that's really important that we heal our veterans that we've sent out. We need to bring them home safely and really bring them home safely. And then there's a group of folks who are from the Army that have convinced an Army base in California to work with the farmer, the rancher who has the lease to graze on that Army base to change to AMP grazing, adaptive multi-paddock grazing. And the Army said, give it a shot. And the guys from the Army who were very influenced by Allen Williams, they talked the rancher into trying it. And I just spoke to the rancher last week. They're five months in, and he's blown away. He's blown away that during a drought in California, by just changing the management of his cattle, he's changing the land in an incredibly beneficial way that makes it more resilient. Produces meat for the soldiers that's healthier. It fits the mission. And that to me -- so we have a lot of this on social media. And so maybe that person who was the Air Force pilot, he could have already seen some of our clips on social media and that might have gotten his attention.

>> Yeah. Yeah, this idea that exposure to healthy nature makes for healthy humans I think also comes out in a subtle way in the films. But one of the big ones is birds.

>> Yeah.

>> We had a couple years ago -- well, it might have been last year in 2024. The Society for Range Management had somebody who's involved in promoting sort of rehabilitation of grassland bird habitat across the western Midwest. And at the tail end of her keynote talk at the Society for Range Management meeting, she played birdsong over the loudspeakers in this plenary session room. And it was really interesting. Everybody got quiet. You could just sense that every pulse in the room went down about 20 beats per minute. And that was just -- you know, that was just a digital reproduction of a birdsong. But this idea that we -- there are so many benefits of promoting biodiversity that you almost can't communicate them all.

>> That's a really, really good idea, the whole idea of playing some birdsong. In our film, we absolutely planned on studying birds and we focused in on grassland birds as part of our focus. But that's what we talk about in the movie. And the bobwhite quail throughout the whole Southeast, throughout all the farms that we talk about, it's a really important bird for the farmers. That's one of the main things I learned on this project was how important the birds are to farmers. And if they find out they're not -- birds aren't landing on their land, then farmers are like, what am I doing wrong? Because I want these birds on my land. And there's this clip in the film where we have a bobwhite sing its song very quickly. And when I do presentations, I use a clip from that moment in the film. And when the bobwhite does its song, everyone laughs. It just brings joy to the room. And that's really -- I think I'm going to do more birdsong in my presentations and just say here's what they sound like and maybe do a couple different birds. I think it's a really good idea. If I may borrow that, that's a really, really good idea.

>> Yeah, have at it. I wanted to ask about some of the claims that you reference as sort of stating the problem. And one of them that I think might have been toward the beginning of the second documentary piece was that --

>> [Inaudible] second episode.

>> Yeah, yeah. The soil loss from farming outweighs the mass of the crops that are grown on that farmland in the United States. Am I remembering that correctly? And can you say more about that?

>> Yeah, that's a graphic in episode two. And we were just saying that if you put all the crops, the main five crops -- let's see if I can remember them. I'll get your help too. Cotton, corn, soy, hay, and wheat. And you put them on one side of the scale and you put the soil that's lost through erosion from all the plowing that happens to then plant all those five crops, the soil will weigh more than those crops annually. I know I was told in Iowa that for every pound of corn that's harvested, two pounds of soil is lost to erosion. So that one crop, that one state, it's a two to one. And, I mean, how do you keep that going? How much soil is there, right? It's not an unlimited resource when you're just taking. But what we find with regenerative grazing is it's pretty amazing how fast they can rebuild it. So it's pretty cool. And then if you look at the greenhouse implications of that plowing and you account for the carbon that gets airborne from that plowing, and you put that into the factoring of how much greenhouse gas warming there is from methane from the cattle in North America versus the plowing and all the greenhouse gases associated with that, that the crop production that we just mentioned, those five major crops, is far more greenhouse gas warmer than the methane from the cattle. And so that's just not being talked about. Everyone is acting like growing plants is the savior for the planet and growing cattle is the destruction of the planet when there's a lot more nuance to both of those statements. But we're finding that when cattle are grazed in a way where most of the land rests most of the time, they never overgraze, and the land can hold a lot more animals, but the land is going to grow a lot more grass, a lot more forage, a lot more of all the things the animals eat, the forbs, the weeds. Everything has a benefit. It's not really a weed if it's nutritious, right? And that the greenhouse, the carbon dioxide drawdown from all those plants, the cooling of that event on the research that we've done far exceeds the warming of the methane and the nitrous oxide that's emitted from these systems and emitted from these animals. So it's a net sink. And that's a big deal. And that's just not talked about. But it's new science, and we understand that, you know, that it needs to be examined and poked at and all those things, which is why we did the research [inaudible].

>> Yeah, I think you made the -- this might have been my paraphrase, but you said something to the effect that the plow is a bigger problem than the cow, which was interesting because it feels like it echoes a fairly famous statement by Aldo Leopold, who is often considered the father of modern conservation or at least wildlife biology. But he is often quoted as having said that the tools to repair degraded land are the tools that we used to tear it down in the first place: The axe, the match, the cow, and the plow. I suspect he would qualify that somewhat with the plow, but I think he could also mean by the plow, seeding, you know, reseeding places that are -- but it communicates the idea that we need to do something. And that that probably has -- I think you do a good job of communicating that there are some significant social implications. You mentioned a minute ago that, you know, it probably is a matter of national security. And actually, Jerry Holechek wrote the textbook on rangelands that everybody uses in undergraduate rangeland ecology education, wrote an article. And the title I think said that, you know, this is a national security issue, meaning that if we have the ability to grow food and fiber in the same spaces that we're growing elk habitat and songbirds and everything else that might be there, do we not have some obligation to try to do that well? His assertion is that we certainly do.

>> Yeah, and the good news is doing it well, if we're looking at what we've studied, you know, regenerative practices are more profitable for the rancher and farmer, and they're much more beneficial for nature. And, you know, nature excels when treated well, and we can grow all the food we need and treat nature well. As a matter of fact, there are a lot of folks who think if we don't start treating nature well, we won't be able to grow all the food we need. And so that it's going to come down to survival, good business, you know, not a love of grassland bird habitat, which is certainly a good reason to do things in concert with nature. But just out of sheer selfishness we're going to have to start working with nature to get what we need as a species.

>> Just to keep farming.

>> Yeah, and I'm cool with different motivations, right? I'm cool with whatever your motivation is. If it's leading to soil health, count me in. You know, we look at soil health as like a big tent that has a lot of entrances. I came through it through the climate change entrance. And like I said earlier, there's a lot of farmers I love and work with, they're not coming at it that way, and that's fine. They're coming at it as an economic decision. They're coming at it from a religious conviction to be a great steward of their land. They come at it from a water security issue or water cycling issue. You could have an engineer coming at it as a flood prevention downstream issue. You've got the national security issue that we've been talking about. And then the whole human health connection that we haven't yet talked about. You know, healthy soil grows healthy, nutrient-dense plants that you could stop right there and eat those plants. The animal that's eating that healthy, nutrient-dense plant will then be healthier and more nutrient dense. And that research is coming in now too. So there's all these entrances into this tent called soil health. And, you know, what we realized when we were making the movie was I've always been looking for common ground in all the work I've done. You know, I've said I've been looking for solutions to climate change. Well, there's a lot of clean energy and energy-efficient solutions that just make good business sense. And so you don't have to be worried about climate change to understand that it makes good sense to just not waste energy. It's just good business. And so always looking for common ground. And when I was out in the field one day with Mike McGraw, one of our bird scientists in the series and on the team, I was realizing that the common ground I'm looking for, now it's actually the ground. It's like that's soil health, right? Everyone I know, everyone, when I describe this work and what the farmers are doing, they smile. Like soil health works for people. It doesn't separate people. It brings people together. And we're getting everybody in our social media campaign commenting. And it's the whole spectrum, the whole spectrum of what you eat from vegan to meat only, from one side of the political aisle to the other, to other sides that don't even exist here. And everyone understands. Everyone trusts nature. That's really what I'm getting at. It's like nature is trustworthy.

>> Mm-hmm. I think, too, one entry point that would be common for nearly anybody who's involved in managing land, for sure farmers and ranchers, is both soil and water. You know, and this stuff is not new. It maybe is more complex than rocket science, but it's also easily understandable. And I was reminded of a research graphic that I ran across some time ago that I've since used in, you know, giving presentations to ranchers about grass cover. But it was a 1937 research study done in Nebraska by the Soil Conservation Service and the University of Nebraska. But it gives soil loss, tonnage, and percent water runoff at different levels of pasture ground cover. And it gives three levels. So for excellent pasture, which they define as having more than 95% ground cover, you have like 15% runoff. And this was I think a simulated rainfall event of like three inches in one hour. And then under the fair pasture, they define that as 75% ground cover. Now they had about 55% water runoff, not infiltrating, and about a half a ton of soil loss per acre. And then the poor pasture had 50% ground cover. Now they had 75% water runoff and more than four tons of soil loss per acre.

>> Wow.

>> And, you know, we're still fighting that battle, trying to get more ground cover, which, as you describe in the film, has lots of other benefits besides just not losing water. But water infiltration is one that's easily communicated.

>> I mean, think of the waste of, you've got this big rain event, and we're getting bigger and bigger rain events, like more water in less time. And you're not capturing every drop of that rain, and it's washing your soil away as well?

>> Especially in the Western U.S. where we're limited by water, which is not the case in, you know, Georgia, maybe.

>> Well, it is, though. That's what I learned. That's not what I learned. One of the many things I learned is a drought in Georgia is very different from a drought in Montana, but it's still a drought. And if you don't get the rain that that land is used to in the amount of time that it's supposed to get it, you got yourself a drought. And there are some massive droughts in the Southeast over the last couple of years. And so droughts are happening everywhere, and, you know, we're just getting bigger spikes of differences. Like, you know, that storm system that just went through, I guess about a week and a half ago, there was fire weather in Oklahoma and Texas while it was creating tornadoes. It's like, you know, all these things all at the same time. But not wasting a drop of water is really important. And, you know, what they call effective rainfall, right? I don't know if that's Allan Savory's statement. I think it might be, or it's -- you know, it works. It's a very apt phrase. And, you know, do you want two inches of rain to go into your soil, or do you want two inches of rain to fall down and it goes away? And who wants to waste water? And one of the things that we haven't quite figured out yet is how to measure dew. Because there's tons of times in our study where, you know, our pants were soaked, like as if we just walked through a creek, and all it was, was the water on the plants. The plants are waist deep, waist high, because that's what the farmer is doing. And just soaked, and there was no measurement of that water, and no measurement of what the benefit of that water going into the soils, and how much cooler are those soils for the microbes to thrive and all the insects to do their game, you know.

>> But that plant-soil interface in that location holds more of that water. It doesn't evaporate.

>> Right, right. And then you go across the fence, and it's the same day, it's the same moisture in the air, it's the same night that you've just gone through, and it's not wet. Or if it's wet, it's only three inches high. And it's just astounding, the difference of just that. And we haven't figured out how to measure that yet. That's something that I would love to somehow figure that one out, how to measure the dew. Because that's more rain, it's more water, it's more precipitation.

>> I want to ask about some of the research results, if you're willing to talk about it. And maybe you don't want to give it away, but I actually think that this podcast crowd is more likely to watch the documentary if they know they're looking forward to some real research results. But I wanted to ask first, was there a connection here with the 3M project, the monitoring, metrics, and management? I did an interview with Derek Scasta and Jeff Goodwin a few years ago on that $19 million national scale project. And Jason Rowntree is one of the PIs on that project.

>> He sure is.

>> And I think that money came online about 2021, and, you know, this was obviously in the works quite a bit longer than that. Was that one of the projects that spun off from this?

>> I would say it, and what's the best way to say it? Jason definitely was inspired by being on this project, and it was part of what created the 3M project. I can't say that it was all that. But this is definitely -- I was referring to Jason when I was thinking about folks on our project have gone and just made big, massive projects. So there's definitely a linear connection. No question. No question.

>> And how did you end up doing -- how did you end up selecting research and filming locations for this project?

>> Let me make sure I heard you right. How did we select the research locations, or was it the researchers that you were asking about?

>> Research locations and, yep, people to talk to and work with.

>> Yeah, so basically how do we select the farmers, right?

>> Yeah.

>> We were going to be doing research on the farms, and we were going to hopefully film the farmers, which was no guarantee. And there was no guarantee that the farmers would be interesting on film. We just got super, super --

>> Right.

>> So what we did, we focused on the adaptive multi-paddock side first, the regenerative side first. And we sent out a questionnaire and put it in two or three magazines and got about 90 to 100 responses that folks were saying, yeah, we're doing some form of the grazing you're talking about. And of those 90 or so that were in the southeast U.S., 25 we thought, let's go scout those. And so Steve Apfelbaum, our lead ecologist and our bird guy, his company did all the water and stuff too, and Ry Thompson, who was project manager for Steve's company for the research. The three of us went and scouted those 25 farms in the Southeast. And of those, we picked five. And then we went next door and scouted the USDA maps for soil types, and then we went and actually once we -- we then did real soil sampling to make sure the soil types were still the same because some of those soils have eroded since those maps were built in the '30s and '40s and stuff. And we found neighbors who were doing conventional grazing in the average way of that county. And three of the five farm pairs are directly across the fence from each other, and then two are down the road from each other. But we matched the soil type and we matched the -- you know, you're grazing regeneratively and you've been doing it for at least -- well, one was seven years and the rest of them were like 20. So they've been doing it for a long time.

>> And how did you define that, whether or not they were grazing regeneratively?

>> Through the survey. We sent the survey out to all those magazines and they wrote us saying, hey, check us out.

>> This is what I'm doing, yeah.

>> And you'll find, at least we found, that anyone who's doing anything on the regenerative side is so anxious to measure, so curious to see what's going on in their land. That was not a discussion of -- that wasn't an arm twisting at all to say, hey, can we do research on your land? With their neighbors, the ones across the fence, it was the relationship of the neighbors that we really got to benefit from. And even though the conventional neighbor was kind of wondering, what do you think we're doing wrong, or you must be thinking we're doing something wrong, they still said yes pretty much because their neighbor asked. And then the other two farms that were sort of down the road from each other, that was more of us talking to them, talking through it, here's why we're doing it. And to all of them we said, here's why we're doing it. I mentioned this earlier. We think we found a way for you to have more benefit from your land than you're getting right now. We don't know. Will you help us by letting us conduct our research? So that's how we found all the farms. And all the farmers said yes to being filmed. We didn't know that was going to be -- that wasn't a prerequisite. This was a science project that had a film component. But if any of the farmers said you can't film me, we wouldn't have filmed them, wouldn't have filmed them at all. But we just got lucky. They all said yes, all of them. And we've had meals with folks after they've seen the film [laughs]. So that makes me feel pretty good. That actually makes me feel really good. And, you know, if I called any of the farmers right now, they'd pick up. And I could ask them how they're doing, and they'd ask me how I'm doing.

>> It was really intriguing. I mean, I'm not a filmmaker, but it seems like the style, the flavor of a documentary is that it's somewhat unfiltered. You're trying to show all of the messiness of an issue, of farmers' lives, of the science, and I feel like it did a good job of showing that. But, you know, you even got into some pretty significant family conflict. I mean sensitive stuff like finances and relationships between kids and parents. But that's the real world.

>> It's the real world, and that sort of comes to fruition and comes to a head in episode two. And I really did not go after the story of the father and son having some real difficulties. I actually didn't poke and didn't prod and didn't investigate that. It just so happened about three years into the project, they all kind of came to us and were open to telling their story. It was kind of given to us where, you know, you can see a lot of film teams would have jumped on that because conflict is good storytelling, right?

>> Right.

>> We definitely didn't jump on it, but it still came to us anyway. And it's hard.

>> Yeah, you get the feeling that it just emerged because that's what was on their minds.

>> Yeah, that's exactly what. And so we treated it with respect and made sure that everything we were saying was accurate to what they told us. You know, that's one thing that's really important. I teach documentary film as well here at Arizona State University, and it's just you've got to keep what someone says in context. You can't take it out of context. Now, one can very easily take something out of context when you're editing a documentary, but I'm saying that we don't do that. And that's another way that, you know, someone who sees the film that they're in, you know, if they're saying something that they didn't mean, and it's easy to know what they meant by what they said. They'd be pissed, and I would hate that. And there was one moment where I was editing this thing. It was kind of complicated. And the way I edited it from a couple different conversations, I sent it to the farmer. I said, is this accurate? Is this what you were talking about? Because I want to make sure I didn't take anything out of context. And the farmer said, yeah, no, that's exactly what I meant. And that's that scene where Cooper Hurst is saying that he wrote a check for $90,000 one year for fertilizer and got no growth, none. And that was his, wait a second, what am I doing here? And I cut that together, and I sent it to him. I'm like, is this -- because, like I said, it was from different conversations. But sometimes you have to make a statement out of different pieces of an interview, but still you want to make sure it's in context. And, yeah, he's like, yeah, that's exactly what I said. That's exactly what I meant. I'm like, Okay.

>> Well, I apologize if it took me too long to get around to it. To ask the obvious question, what were you measuring as indicators of health on these farms?

>> Sure. I'll list them out. We measured soil carbon content, soil nitrogen content, water infiltration rates, the plant cover, and then the nutrient density of the plants, the diversity of the plants, how many species. We measured the microbial communities. Again, how many different species and how much of each species. We measured bugs. Same thing, how many species, how much of each species. Excuse me. We measured the greenhouse gas cycling where we focused on the three main greenhouse gases on a farm system: The CO2, carbon dioxide, the methane, and the nitrous oxide. And those greenhouse gases were measured in a ton of different methods with new technology, old methods, and then that's the last piece of our work that's yet to be published. Everything else to date is published. We did birds. So everything I've just described other than the greenhouse gas data is published. And so we have 13 papers, and they're all on our website, which is where you can see the series, which is rootssodeep.org. And you get to the website, you'll see exactly how you can rent the series. In March, it's basically 9.99. It was 19.99 before March. Not sure what it's going to be in April, but you get it for three months. And so folks can watch it how they will. Sometimes you just can't make the time to watch four episodes all at once. And we measure the animal well-being through different metrics of, you know, just how you look at an animal's health. And then we also asked a lot of questions to the farmers, how are they doing. And the farmer well-being work, that social science work, was to be published anonymously. So that's not filmed. But we get a good sense of how farmers are doing just through the questions we were asking as we were filming. So it's not missing, but it's not the science piece of social science that was also part of our team.

>> Mm-hmm. I have to say that I was a little bit surprised by the results because I'm prone to think that this stuff makes a difference. But in science, you oftentimes have to make much of really small differences. And some of these differences were not so small. Are you willing to talk about some of what you found in the results?

>> Well, I mentioned the greenhouse gases where we found that it was -- AMP grazing is a strong greenhouse gas sink when accounting for the warming of the methane, the warming of the nitrous oxide, and the cooling of the CO2 with so much plant growth coming down. The cooling eclipses the warming of the other two greenhouse gases. Everything we measured, I guess -- without going into too much detail, everything we measured was significantly better, healthier on the adaptive side of the fence than the conventional side. It was just across the board. And, you know, this is us measuring all five farm pairs because this is five farm pairs, five farms that are adaptive grazing and across the fence or a couple down the road doing the conventional grazing. And then we average out those five farm pairs. There's a couple of anomalies in there. One farm pair in Tennessee, there was more grassland birds on the conventional side than the adaptive side. And we did all our counts before they hayed. And so we're pretty sure that once they hayed, those numbers would have been quite different because a lot of those families of birds wouldn't have made it through the haying. And then there was a water situation in Kentucky where there's just a lot of caves, a lot of crazy different ways that water can seep down through the soil into a cave. And one of our places where we measured in Kentucky was on top of this hill. And you just couldn't fill the water infiltration unit fast enough. The water was just crunching right through. And so we're pretty sure it was cave systems that caused that. But when you develop the system, we had replication. And so we had five replications on five farm pairs. And when you average it out across the board, it was significantly more productive, more healthy, more -- like just looking at the nitrogen. If you just look at the nitrogen in the soil, the conventional farmers put nitrogen down. They add nitrogen to their system to help them grow their grasses that they've planted. And yet the adaptive farmers, who don't put nitrogen fertilizer down because they're using the animals as their fertilizer system, had more usable nitrogen in their soil. And so think the money that the farmers on the adaptive side are saving. Like Cooper said, he wrote a check for $90,000 once and he got nothing. And so just that alone is a significant difference in costs and time, all those things.

>> Yeah, the bird results surprised me a bit, partly because these are not very large properties. And so I would assume that bird diversity and abundance would be responding to habitat conditions over a much larger area, you know, sort of a macro landscape perspective. But there were significant differences in terms of where birds spend their time.

>> And where they didn't, you know, sort of die off because there was no place for them to raise their families. I think the words extirpate, extirpation, where it's not extinction, but that family unit is gone because there's no place for them to raise the next generation. Yeah, it was significant. And, you know, in the Southeast, you know, we had some farms that were 1,000 acres, 1,200 acres, 300 acres, some that were much smaller, 80, 90, 100 acres. The pairs were kind of similar, generally similar. But when we were talking about earlier, you know, doing real world research, it gets a little bit messy. But what we did, though, is we worked really hard to make sure the soil types were the same. And as much as the slope and aspect were the same, where we did our studies, where we did our measurement. And so we worked really hard to make sure that the land and the history of the land was as apples to apples as possible. The only difference was the management. So you were talking about how, you know, science wants to have that one difference and then, you know, tease out answers. Well, we worked really hard. And the soil types, when it went through the labs at Colorado State, we nailed it. They were dead on. And it was really exciting. If you just put the graph of one soil type and the neighbor across the way, right on top of each other, it was almost the exact same. Very busy, very squiggly up and down lines demarking the soil type and its qualities. But the birds, they land where they want. And it was just as stark as can be. In Woodville, Mississippi, on one side of the fence, on the regenerative side, they had, I think, six species of birds and 193 of them counted in the bird counts that we did, which was two people, four times a year, two years. And across the way, it was two species and three birds total. It was astounding, the difference. And that's really what, for me, as just a person who likes to hike and enjoy nature, but I don't know anything about farming. I know a tiny bit right now, but I'm not a farmer. But when you go on these lands where people are working with nature, the difference of the sounds, because you're hearing birds and bugs. The difference of the smells, because you've got so much more plants growing, so many different plants growing. And the difference of the soil itself, it's squishier on the healthy side and it's harder and compacted on the other side. You can't help but notice that. It's just right there.

>> And there's sort of what I would call keystone indicators. Like there have to be a lot of things going right for those things to change. And so it's difficult to assign causality to it because it's not a single thing. Like birds are not just responding to insect populations. It's also vertical structure of vegetation and whether or not they have nesting habitat and a whole host of things. The insects is really interesting. I think I saw in some news this morning that some researchers at Cornell were identifying or finding that commercial honeybees died off in 2024 at a higher rate than in any year measured previous to that.

>> Devastating.

>> And this is one of those things that we've had a hard time getting our brains around. WSU has an apiary and quite a bit of honeybee research going on. I remember one of the guys who runs the apiary saying several years ago that they were doing research on -- I don't know how they followed it, but somehow they were able to track individual honeybees like on where they're working in almond orchards in California. And he said they documented honeybees flying three miles across oceans of almond blossoms to find a single dandelion plant because they're seeking out some diversity in their diet. And of course, you know, again, insects are -- their population changes are responding to a whole lot of things that are underneath that, not just diet. But it's one of the reasons why I think it's easy to say that diversity of all kinds is important. I think it's also one of the reasons why this adaptive multi-paddock grazing works well for birds because those pollinators have to have soils that are healthy and have macropores and aren't full of insecticides.

>> Yeah. Yeah. And that's where Jon Lundgren's work would come in. And he's done a lot of work in almond orchards in California. As soon as people added grazing to those almond orchards, man, the soil health just exploded and the productivity of the almonds exploded. And the water retention of the system seemed to have just gotten phenomenal. You know, animals and landscapes, they work really well together if you let them. And it takes intervention. It takes management. There's no doubt. There's no doubt. Because we're using animals as proxies for what used to be here. And there's just no way to have what used to be here anymore. We don't have, you know, entire continents of landscapes available. And there's just too many roads, too many people, too many patchworks of land.

>> Right. And too much land that got converted. You know, we need people growing food. I've got nothing against farmers, but it is a plain truth that you don't grow corn without removing everything that was there before the corn field. And that has some consequences, which we're discovering now might be global consequences. It's always made me a little bit sick to think about the tall grass prairie getting plowed under.

>> Oh, it's horrible.

>> And that was even before I learned more about how bad it was in reading Tim Egan's really good book, The Worst Hard Time, about literally a perfect storm of the Dust Bowl in the Great Depression. But yeah, at one time, we plowed what was considered arable land. And then you had all of the field edges and stuff that was considered not really cultivatable outside of that that still remained habitat. But as Wendell Berry describes in some of his books, at some point, economic pressures and tractors pushed all of that to property lines where literally you could have dozens of miles where there's nothing but plowed ground.

>> And we're losing 1 to 2 million acres of grasslands every year here in the U.S.

>> Still?

>> Yeah, but we don't have to. We don't have to lose that land. We don't have to do that. We can regenerate the land. We can let the animals live on grasslands their whole lives. We can make this a very productive continent. We can be a beacon for the world. And that's really what I've learned from all the ranchers and farmers and the scientists that I work with. It's so doable, and it's profitable for the farmers, and it's profitable for the communities, and it's profitable for the cities downstream because the flooding gets mitigated. So many good reasons, so many good reasons to work with nature. So that's why we're focused on it for so many years.

>> It was really interesting that you had the Alabama band lead, Randy Owen, in the film. One of my favorite song lines from Alabama, which I quote all the time, is from his song or their song, 40 Hour Week, which is good poetry that you could read independent of the music. But in the song it says, there are people in this country who work hard every day, but not for fame or fortune do they strive. But the fruits of their labor are worth more than their pay. And that's the line that has always stuck in my head. Back to this existential threat of not having local agriculture. If we don't have people who do the kind of work, you know, that's not flashy and not widely recognized, but they generate what they -- I feel like this is sort of true wealth. And I'm not an economist and only a poor philosopher, but, you know, true wealth has to be where people are doing something that's worth more than what they're getting paid for it, and then that circulates in an economy. You know, but this idea that people that grow food are not doing it for fame and fortune really almost perfectly describes the socioeconomic research on the return on investment in farming, namely that most farmers could sell off their capital assets and put it on the stock market and make more money. But they don't because they love what they do, and it gives them meaning. Or at least they did, and I think that's been changing. You know, you allude to some of this in the films where it just kind of flirts with this idea that farm debt and stress and the disconnect with living land I think is removing some of that motivation that used to keep people going even when they weren't making a profit. And what I'm seeing here is that, you know, you're trying to promote ideas that bring back both profit and a feeling of fulfillment that people can be proud of what they do.

>> Absolutely.

>> My last question was how has the documentary been received, and then what would you like listeners to do with it besides go watch it?

>> Definitely watch it. You know, as the filmmaker, I'm hearing all the good stuff, so I haven't seen any -- hardly anything written online that's negative. It's been universally well received, which is a really good feeling because there's so many really good people in this. I want listeners to find out where they're buying their meat and buy it from folks who are regeneratively grazing their animals. I want listeners to know they can call grocery stores and ask for grass-fed, grass-finished meat. And it only takes about eight people, 8 to 10 people to really get the store's attention. I want people to understand that farmers can be a huge part of the solution for a lot of our problems, but that doesn't mean that it's anywhere close to enough farmers are doing it right now. It's still a small, small number of farmers that are really focused on soil health. And so we need to get more and more farmers aware that soil health is an option. Let the farmers make the decision of whether they want to adopt different practices, but let's make sure every farmer knows that this is an option. And that's really why we're working so hard on our outreach as we build communities online through a service called Discord, where we're building people online through all of the other normal social media channels. We're partnering with Soil Health Academy and making sure that all their amazing teachers are available for folks who want to learn. We are getting stories every day through our social media campaign. We've gathered 715,000 followers in the last 18 months, and our social media clips that have been seen have been seen 114 million times. I just got the data today. We get it every Monday from our team. And so there's a huge appetite for people who want nature to be a part of how we make our food. There's obviously big industries that have been built and evolved that don't really do that, but the more people want it, the more other industries will have to respect it and will have to make pivots. And so the value of the consumer, the value of the farmer, the value of the person who eats food, the value of the individual, it's all very powerful. And it all comes down to soil health. The value of soil health is to be loved and cherished. It really is good news.

>> Yeah, and to that end, one of my primary takeaways from watching the series, which I just finished up yesterday, was that neighbors need to talk to each other. We're more connected through mind-blowing technology than ever before, but people are lonely and need thicker connections. So I felt like one of the takeaways that I think you really did hammer home was, you know, get off the television, get off your phone, and get onto the front porch or in the back pasture and have your neighbor over for a cup of coffee or a glass of wine and spend time talking to each other, learning from each other, and influencing each other.

>> It certainly worked well in our project. I'll tell you that. It worked really well.

>> Well, Peter, I think this will continue to have positive results. And I can't tell you how excited I am that it's been as big as it is so far. And I thank you. What can people do to take action either to learn or to promote this?

>> Well, you can see the series at rootssodeep.org. It's rentable. And then our social media campaign, our handle is @carboncowboys across all the channels, whatever one you like. We're on there, and that's our handle. So those are the two ways of moving this ball forward.

>> Excellent. Thank you.

>> Thank you.

>> Thank you for listening to The Art of Range podcast. Links to websites or documents mentioned in each episode are available at artofrange.com. And be sure to subscribe to the show through Apple Podcasts, Podbean, Spotify, Stitcher, or your favorite podcasting app so that each new episode will automatically show up in your podcast feed. Just search for Art of Range. If you are not a social media addict, don't start now. If you are, please like or otherwise follow The Art of Range on Facebook, LinkedIn, and X, formerly Twitter. We value listener feedback. If you have questions or comments for us to address in a future episode or just want to let me know you're listening, send an email to show@artofrange.com. For more direct communication from me, sign up for a regular email from the podcast on the homepage at artofrange.com. This podcast is produced by Connors Communications in the College of Agricultural, Human, and Natural Resource Sciences at Washington State University. The project is supported by The University of Arizona and funded by sponsors. If you're interested in being a sponsor, send an email to show@artofrange.com.

>> The views, thoughts, and opinions expressed by guests of this podcast are their own and does not imply Washington State University's endorsement.